All Categories

Featured

Table of Contents

Of training course, there are various other benefits to any kind of whole life insurance coverage policy. While you are trying to decrease the proportion of premium to death advantage, you can not have a plan with zero death benefit.

Some people offering these policies say that you are not disrupting compound rate of interest if you obtain from your policy rather than take out from your financial institution account. The money you obtain out earns absolutely nothing (at bestif you do not have a laundry car loan, it might also be costing you).

That's it. Not so hot now is it? A whole lot of individuals that get right into this idea additionally acquire into conspiracy theory theories regarding the globe, its governments, and its banking system. IB/BOY/LEAP is positioned as a method to somehow prevent the world's monetary system as if the world's biggest insurance companies were not part of its economic system.

It is invested in the general fund of the insurance policy firm, which mostly spends in bonds such as US treasury bonds. You obtain a little bit higher interest rate on your money (after the very first few years) and perhaps some possession security. Like your financial investments, your life insurance policy must be boring.

Can You Make Your Own Bank

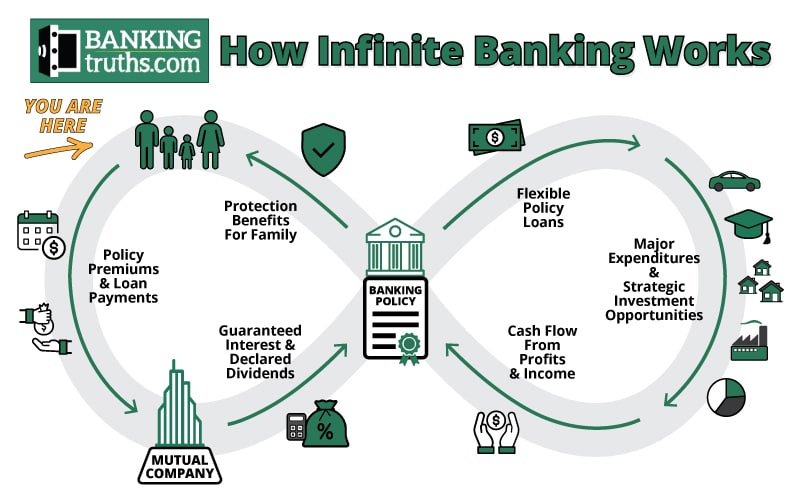

It appears like the name of this concept adjustments once a month. You might have heard it described as a perpetual wealth method, household financial, or circle of riches. Whatever name it's called, boundless banking is pitched as a secret way to develop wide range that just abundant people learn about.

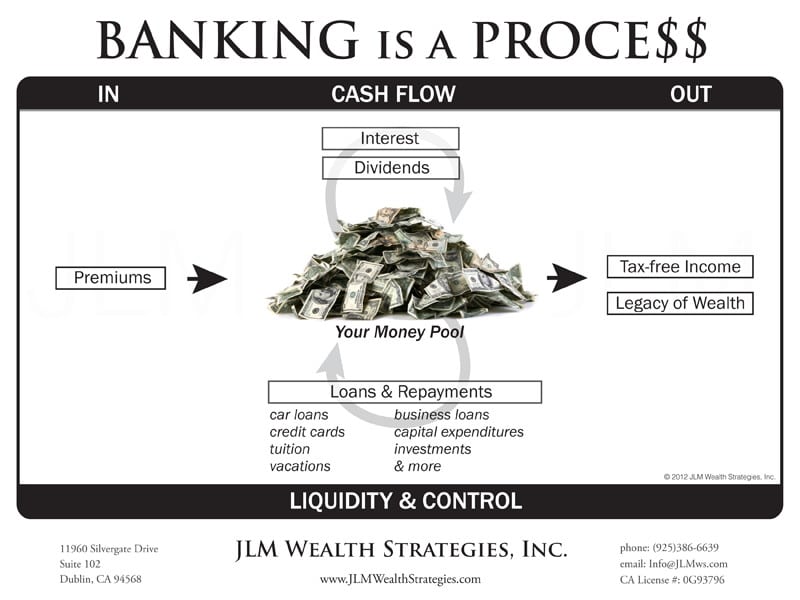

You, the insurance policy holder, placed money into a whole life insurance policy with paying premiums and getting paid-up enhancements.

Infinite Banking With Whole Life Insurance

The whole idea of "banking on yourself" only functions because you can "financial institution" on yourself by taking loans from the policy (the arrow in the chart over going from entire life insurance policy back to the insurance policy holder). There are two various sorts of finances the insurer may supply, either direct recognition or non-direct recognition.

One feature called "clean fundings" sets the rate of interest on finances to the very same rate as the dividend price. This suggests you can borrow from the policy without paying passion or obtaining rate of interest on the quantity you borrow. The draw of boundless financial is a dividend rate of interest and guaranteed minimal rate of return.

The drawbacks of infinite banking are usually ignored or otherwise mentioned at all (much of the details available about this idea is from insurance agents, which may be a little biased). Only the cash worth is growing at the reward price. You also have to pay for the expense of insurance, fees, and costs.

Firms that use non-direct acknowledgment fundings might have a reduced returns price. Your cash is secured right into a difficult insurance product, and abandonment fees typically don't go away up until you've had the plan for 10 to 15 years. Every permanent life insurance policy plan is various, yet it's clear somebody's overall return on every buck invested in an insurance policy product can not be anywhere near to the returns rate for the plan.

Benefits Of Infinite Banking

To offer a very standard and hypothetical example, allow's think somebody has the ability to gain 3%, on standard, for each buck they spend on an "limitless financial" insurance policy product (besides expenditures and fees). This is double the estimated return of entire life insurance policy from Customer News of 1.5%. If we assume those bucks would go through 50% in tax obligations total if not in the insurance coverage product, the tax-adjusted rate of return might be 4.5%.

We assume higher than typical returns overall life item and a very high tax obligation rate on dollars not take into the policy (that makes the insurance coverage item look better). The truth for many people might be worse. This fades in contrast to the long-term return of the S&P 500 of over 10%.

Scb Priority Banking Visa Infinite

At the end of the day you are getting an insurance coverage item. We enjoy the security that insurance coverage uses, which can be obtained much less expensively from an affordable term life insurance coverage policy. Unpaid car loans from the plan may additionally reduce your fatality benefit, lessening one more degree of defense in the policy.

The principle only functions when you not only pay the substantial costs, but make use of extra cash money to acquire paid-up enhancements. The chance cost of all of those dollars is incredible very so when you might instead be buying a Roth Individual Retirement Account, HSA, or 401(k). Even when compared to a taxable financial investment account and even a financial savings account, boundless financial may not offer equivalent returns (compared to investing) and equivalent liquidity, gain access to, and low/no cost framework (contrasted to a high-yield savings account).

When it involves economic planning, whole life insurance policy frequently sticks out as a popular option. However, there's been a growing pattern of advertising it as a tool for "infinite banking." If you have actually been checking out whole life insurance policy or have come across this idea, you might have been informed that it can be a way to "become your own financial institution." While the idea may appear enticing, it's essential to dig deeper to comprehend what this really indicates and why watching entire life insurance policy this way can be deceptive.

The concept of "being your very own financial institution" is appealing since it recommends a high degree of control over your financial resources. Nevertheless, this control can be illusory. Insurance provider have the supreme say in exactly how your policy is managed, including the terms of the finances and the rates of return on your cash worth.

If you're taking into consideration entire life insurance policy, it's vital to see it in a wider context. Entire life insurance policy can be a valuable tool for estate planning, giving an assured survivor benefit to your recipients and potentially providing tax obligation advantages. It can also be a forced savings lorry for those who have a hard time to save money constantly.

Paul Haarman Infinite Banking

It's a kind of insurance policy with a savings part. While it can provide steady, low-risk growth of money worth, the returns are typically reduced than what you might accomplish via various other financial investment vehicles. Prior to delving into whole life insurance policy with the concept of limitless banking in mind, take the time to consider your economic objectives, threat tolerance, and the full variety of monetary products readily available to you.

Boundless banking is not a financial panacea. While it can function in particular circumstances, it's not without risks, and it requires a considerable commitment and recognizing to manage effectively. By acknowledging the potential risks and recognizing the true nature of entire life insurance coverage, you'll be better equipped to make an enlightened decision that supports your economic wellness.

This publication will certainly educate you exactly how to establish up a financial plan and just how to make use of the banking policy to purchase genuine estate.

Boundless financial is not a product and services offered by a certain institution. Boundless financial is an approach in which you buy a life insurance coverage policy that accumulates interest-earning cash worth and secure fundings versus it, "obtaining from yourself" as a source of capital. Then eventually pay back the financing and start the cycle throughout again.

Pay policy premiums, a part of which builds money value. Cash money worth earns worsening passion. Take a lending out against the policy's money worth, tax-free. Repay car loans with interest. Cash money value accumulates again, and the cycle repeats. If you utilize this concept as planned, you're taking money out of your life insurance coverage policy to purchase whatever you 'd require for the rest of your life.

Latest Posts

5 Steps To Be Your Own Bank With Whole Life Insurance

Tomorrow's Millionaire - Become Your Own Boss

Learn How To Become Your Own Bank!